Understanding Tariffs: What Every Trailer Dealer Needs to Know

Author: Mark Sheffield, NPDA

It’s easy to assume tariffs are just a price increase tacked onto imported trailers. But for light and medium-duty trailer dealers, the reality is much more complex—and not knowing how tariffs actually work can lead to unnecessary costs on your books.

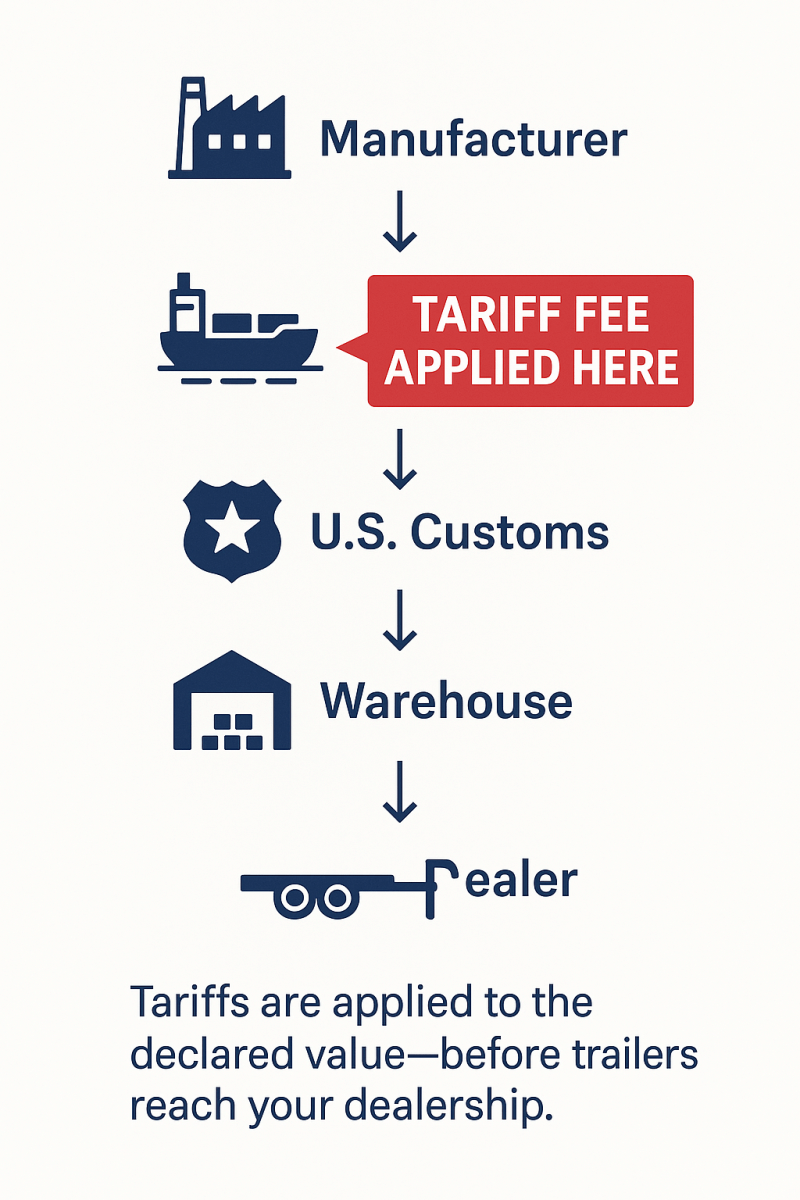

Tariffs Are Calculated Long Before You See a Trailer

Let’s clear up a common misconception: Tariffs aren’t based on the price you pay as a dealer. They’re based on the declared value of the shipment when it lands at a U.S. port.

If a container of imported trailers arrives with a declared value of $1 million, and it's subject to tariffs, the importer pays a fee—sometimes hundreds of thousands of dollars—before the units even leave the port.

What That Means for Your Dealership

Say you purchase a medium-duty trailer for $10,000. That’s your cost. But on the customs paperwork, the declared value might only be $5,000. The remaining $5,000 often accounts for warehousing, logistics, domestic distribution, and the importer’s margin.

That means the tariff is being applied to $5,000, not $10,000—and that difference opens up room for strategic cost management upstream.

How Importers Are Legally Reducing Tariff Costs

Here are some of the methods importers use to reduce their tariff liabilities—many of which affect your final price even if you’re unaware:

1. Sourcing From Strategic Countries

Importers often partner with manufacturers in countries with favorable trade agreements to cut or eliminate tariffs.

2. Shifting Final Assembly

By finishing trailer assembly in another country, importers can legally change the country of origin—qualifying for lower duties.

3. Breaking Down Components

Importers can itemize trailer parts on customs declarations to isolate tariff-exempt components, lowering total fees.

4. Tariff Engineering

Altering the design or importing parts separately for U.S. assembly can place trailers in lower-duty classifications.

5. Using Foreign Trade Zones (FTZs)

Goods stored or modified in FTZs may be eligible for delayed, reduced, or even eliminated tariffs, especially if re-exported.

6. Accurate Tariff Classification

Incorrect Harmonized Tariff Schedule (HTS) codes or inflated declared values often lead to overpayment. Precision matters.

7. Duty Drawback Programs

Some importers qualify for refunds on tariffs for goods that are later exported—a strategy that’s underutilized in our industry.

Tariff Specialists Are On the Rise

Expect to see tariff consultants offering services to OEMs, importers, and even high-volume dealerships. Some will be seasoned trade experts. Others may lack credibility.

For trailer dealers, you don’t need to become an international trade expert, but understanding these basics can help you:

-

Hold vendors accountable

-

Avoid absorbing costs unnecessarily

-

Ask the right questions before price increases hit your lot

Final Thoughts: Be Informed, Stay Competitive

Tariffs may be unavoidable, but how they impact your dealership isn’t set in stone.

By learning how upstream cost strategies work, you’ll gain insight into your pricing, protect your margins, and avoid blindly accepting increases that may not be justified.

About the Author

Mark Sheffield is a U.S. Army veteran and a 30+ year veteran. He currently advises Woods Cycle Country and Woods Indian Motorcycle, and consults for NCM & Associates while serving on the board of the National Powersports Dealer Association (NPDA).

Follow Mark on LinkedIn for more insight into import logistics, dealer operations, and margin protection.